The government has scheduled the long-awaited closure of the Customs Handling of Import and Export Freight (CHIEF) system for imports in September 2022 and exports in November 2023.

This will be replaced by the new Customs Declaration Service (CDS) for all declarations of goods departing from and arriving into Great Britain.

Since 1st October 2022, CDS has been live for imports both for inventory linked and GVMS arrivals into the UK.

HMRC had published the deadline for the full migration for CDS exports of 30th November 2023, but have announced a new phased approach deadline of 30th March 2024.

If you import and have registered for CDS for imports, you are good to go and ready for CDS exports, if you are not currently registered you will need to do so, following the guide below.

STEP 1: Please follow this guide to Register for access to CDS

First, go to the page here – and select the ‘Subscribe now’ button and log in using your 12 digit Government Gateway ID and password.

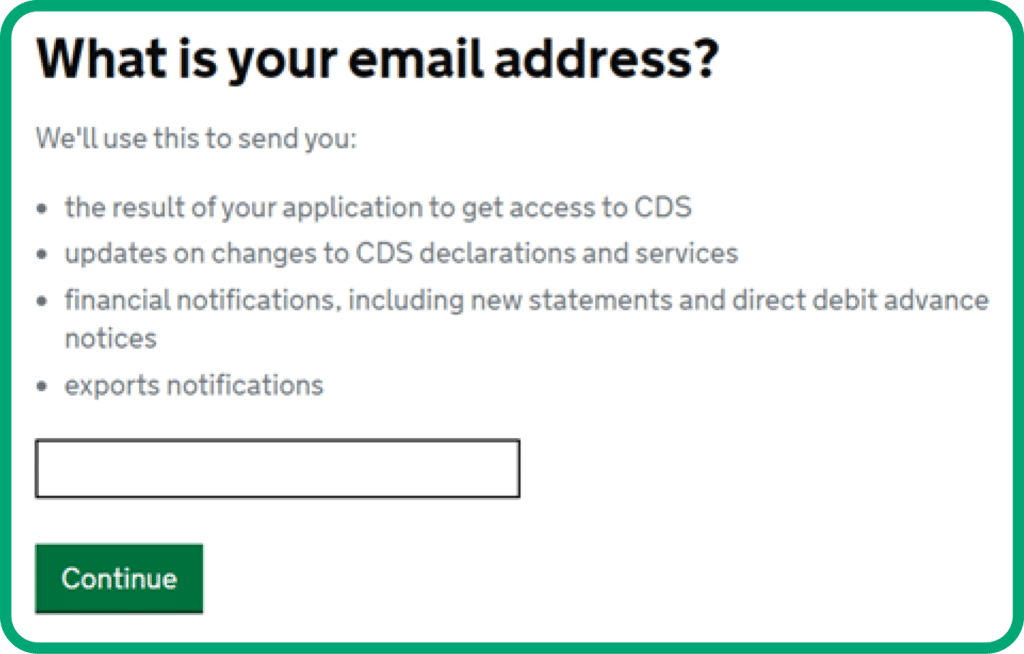

Enter the email address which will receive notifications about CDS. This does not necessarily need to be the email which registered for the Government Gateway ID.

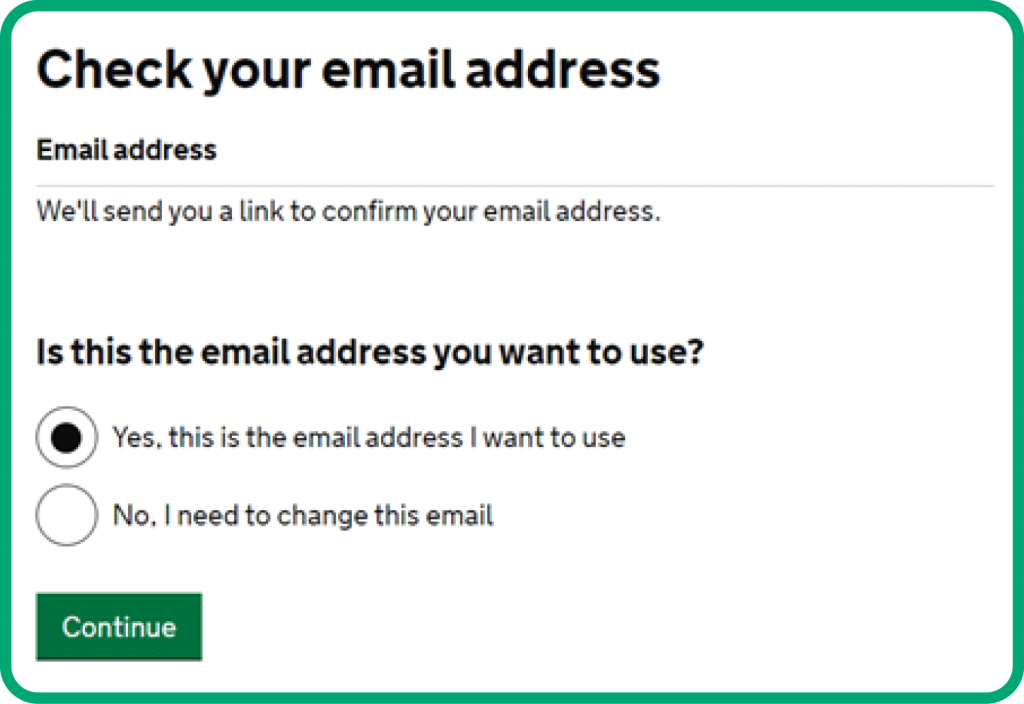

Check the email address and confirm it as correct.

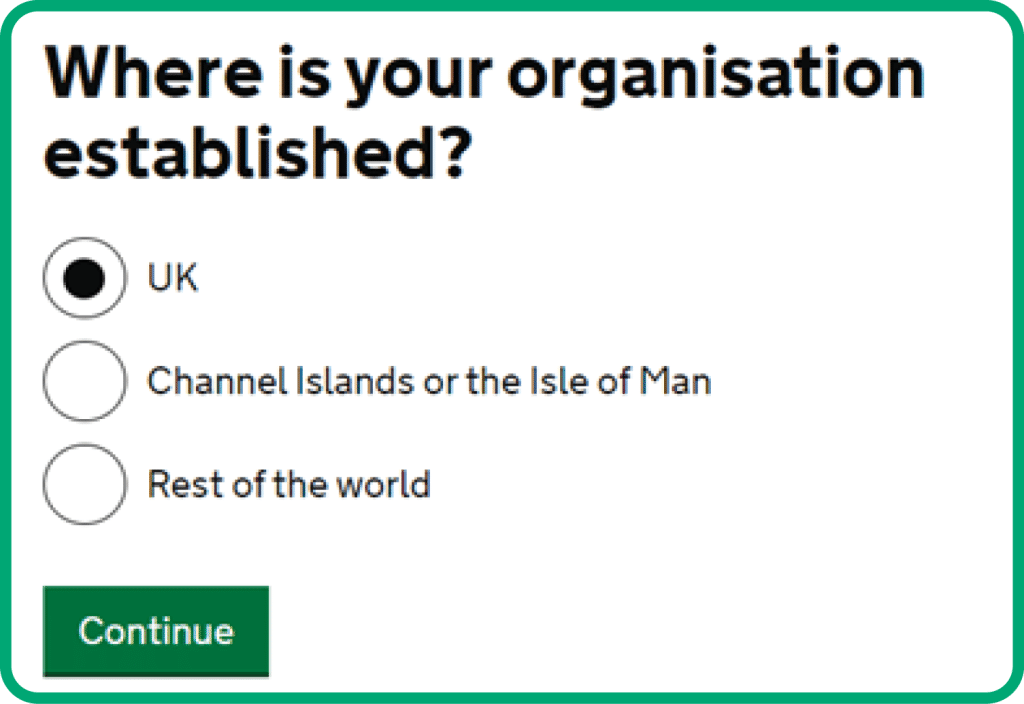

Continue by answering where the business is established. Even if not established in the UK, you can still continue registering for CDS as long as you hold a GB EORI number.

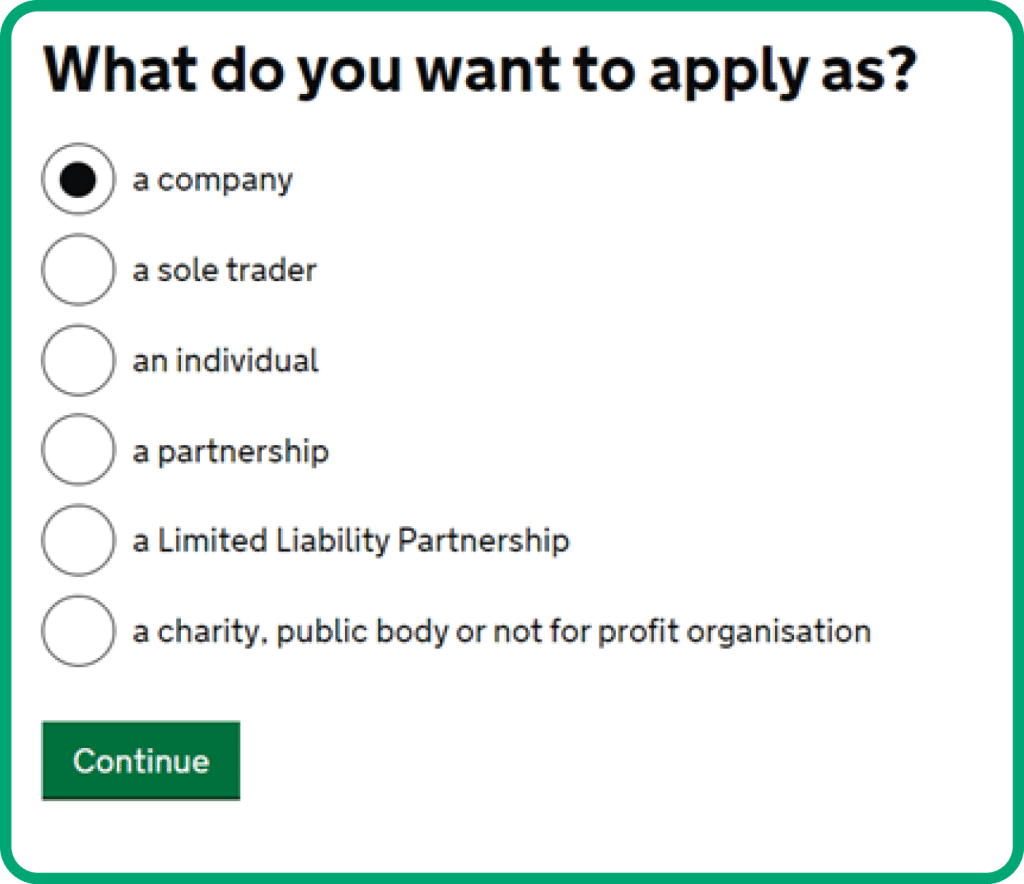

Select the type of organisation you are applying as.

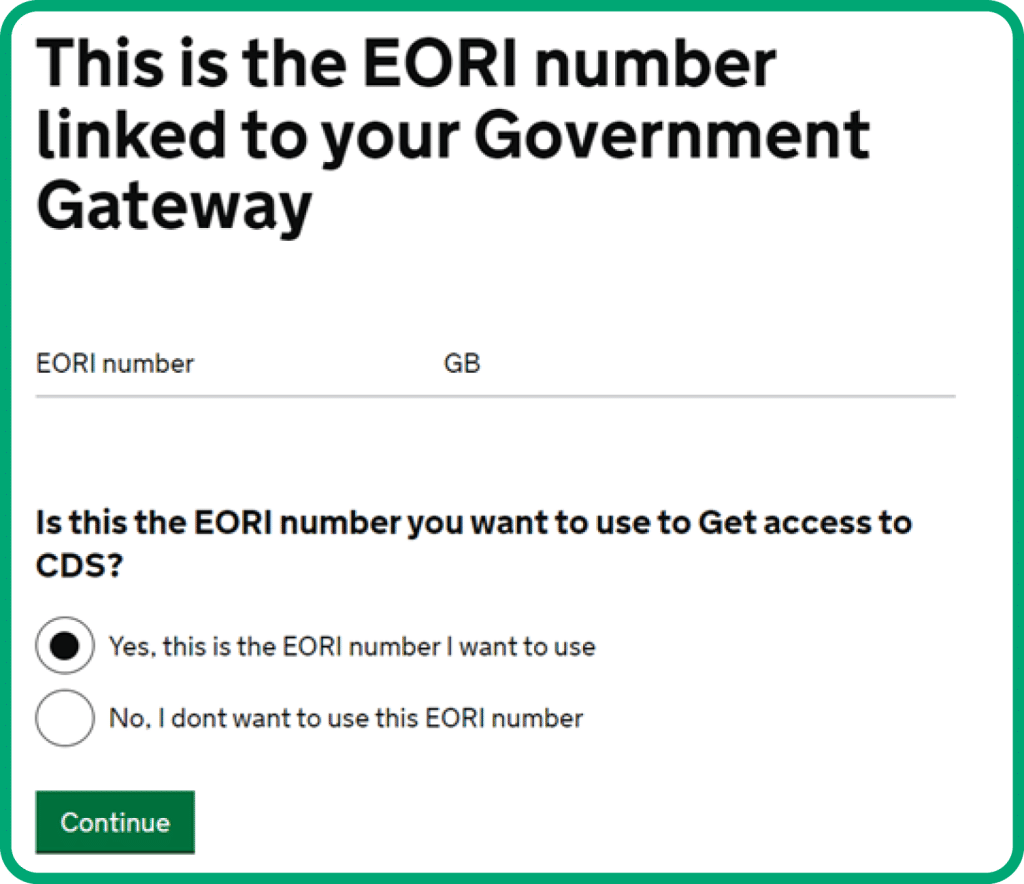

If your account is already linked to an EORI number, check and confirm that the EORI used for registering your Government Gateway account is the same EORI you wish to use for your CDS registration.

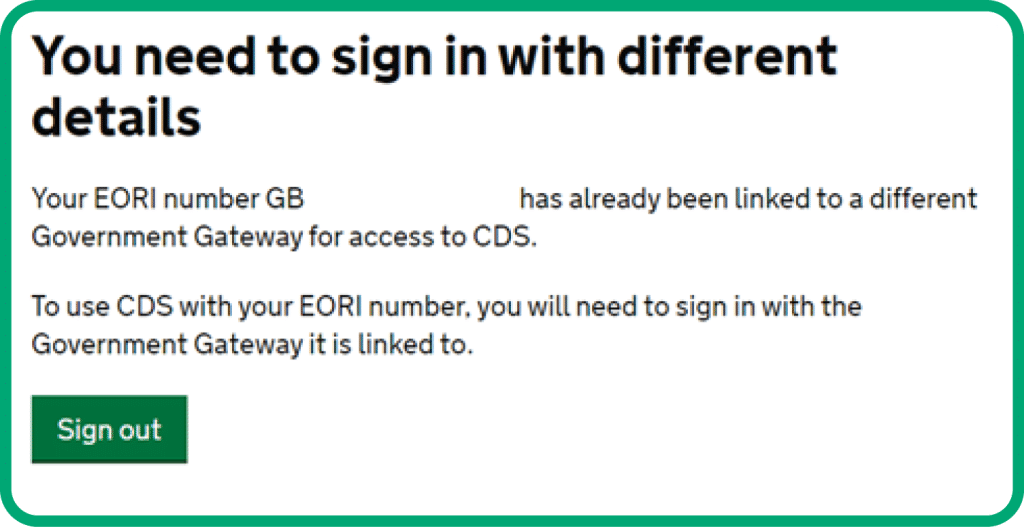

Note: If someone within your organisation has already registered for CDS using that EORI then you’ll receive the following. You’ll need to check within your organisation on who/when this was completed.

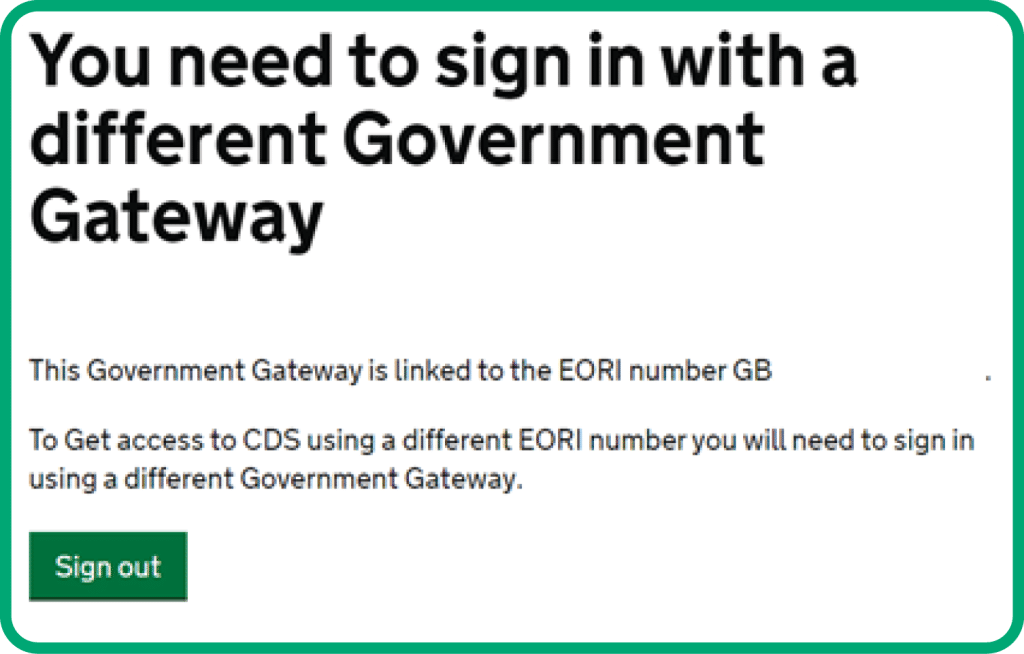

Note: If you select that you want to use a different EORI number than what was used when registering for you Government Gateway account then you’ll receive the following. You’ll need to start again on a new Government Gateway account with a corresponding EORI used.

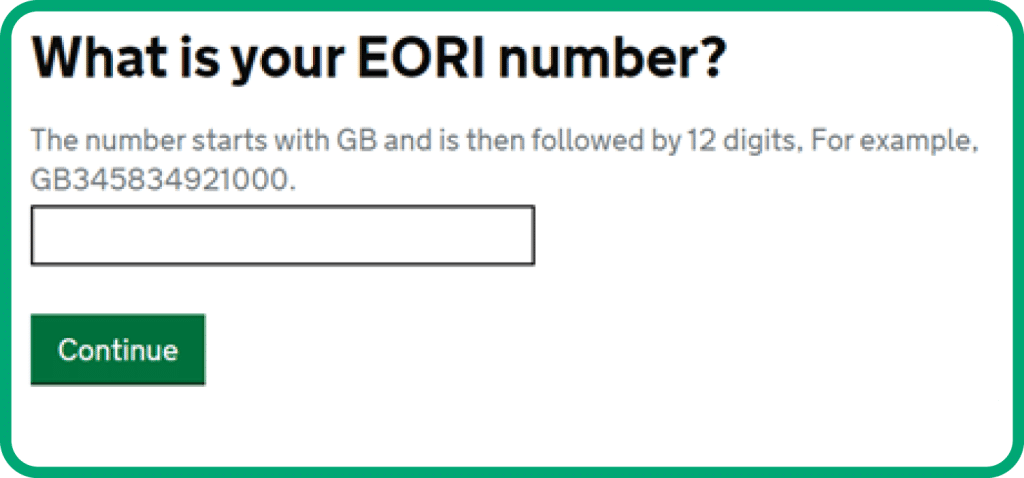

If your account is not currently linked to an EORI, then you will need to enter it on the page after choosing your organisation type.

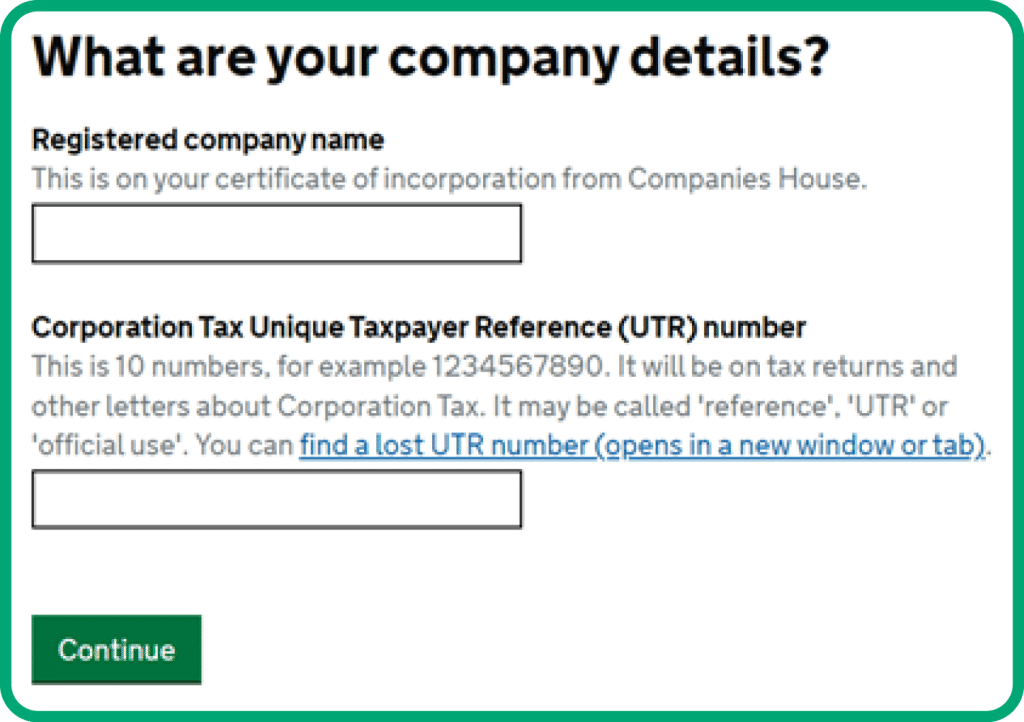

Depending on the type of organisation you selected, you’ll be presented with a page to enter further details. For limited companies this will be as below where you will need to check the name registered at Companies House, which you can check here – as well as your 10 digit UTR.

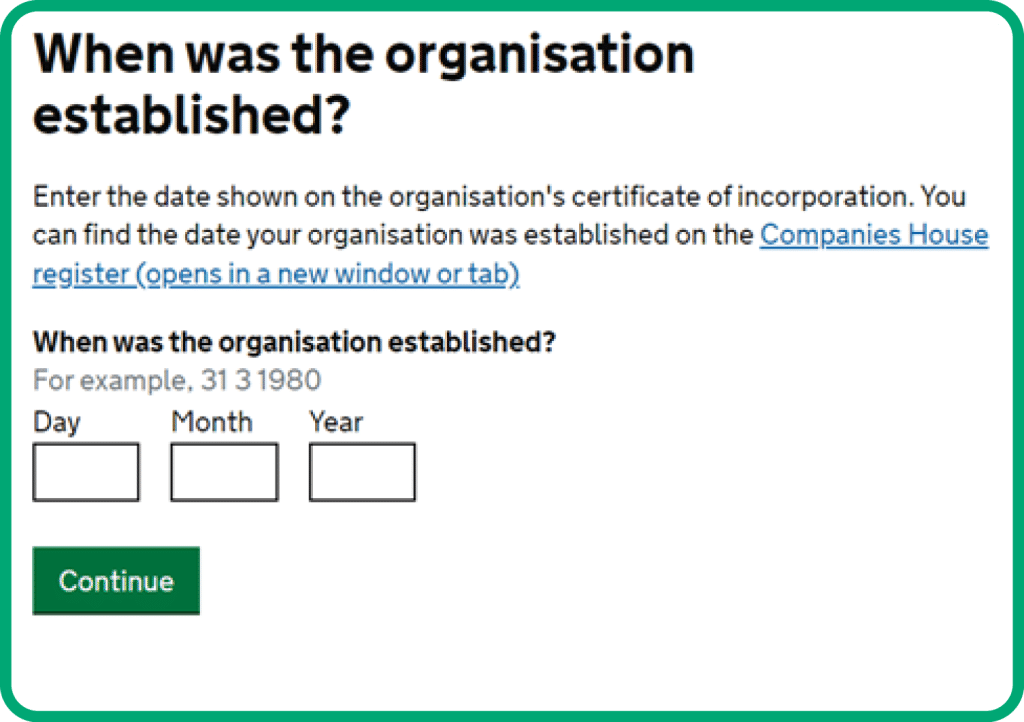

Next enter the date which the organisation was set up. This can either be taken from Companies House – https://find-and-update.company-information.service.gov.uk/ – or from your business records with HMRC.

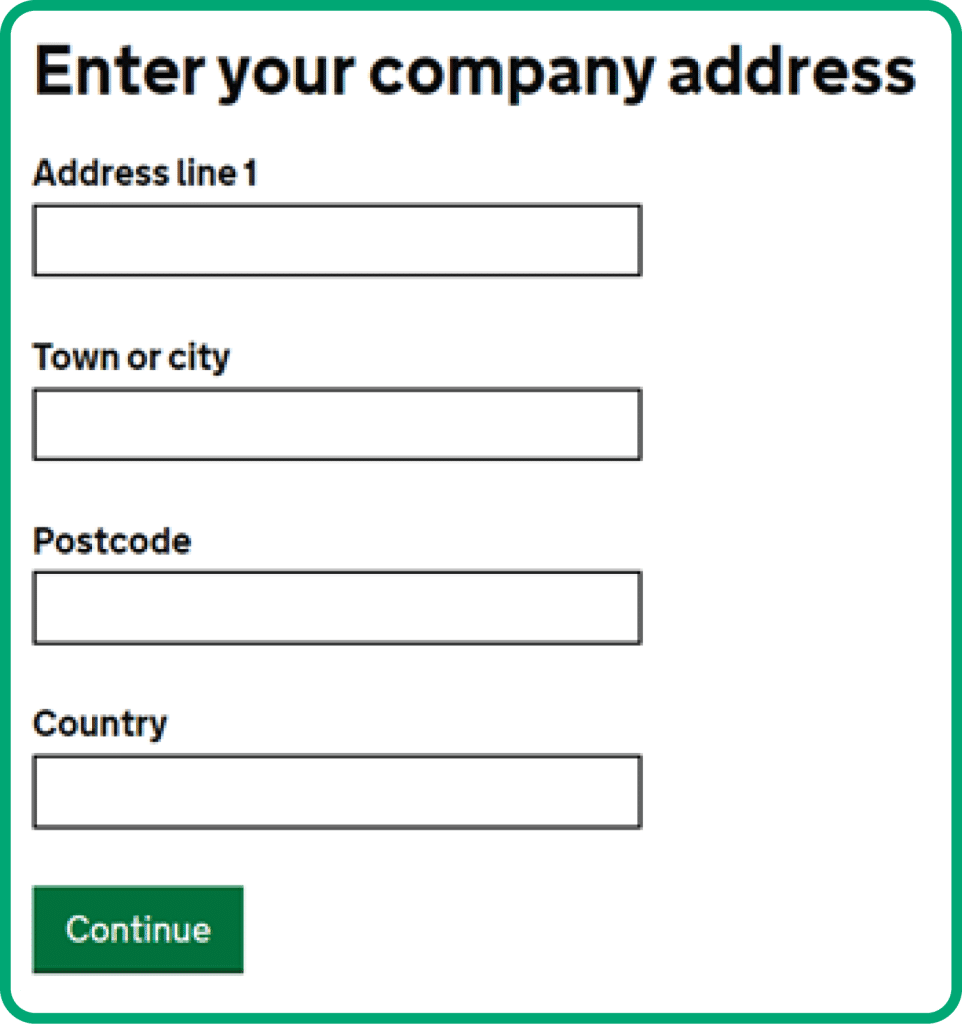

The next page requests you to enter the company address. This is not necessarily the address that is listed as the registered address at Companies House. This should be the address that is held on your business records with HMRC.

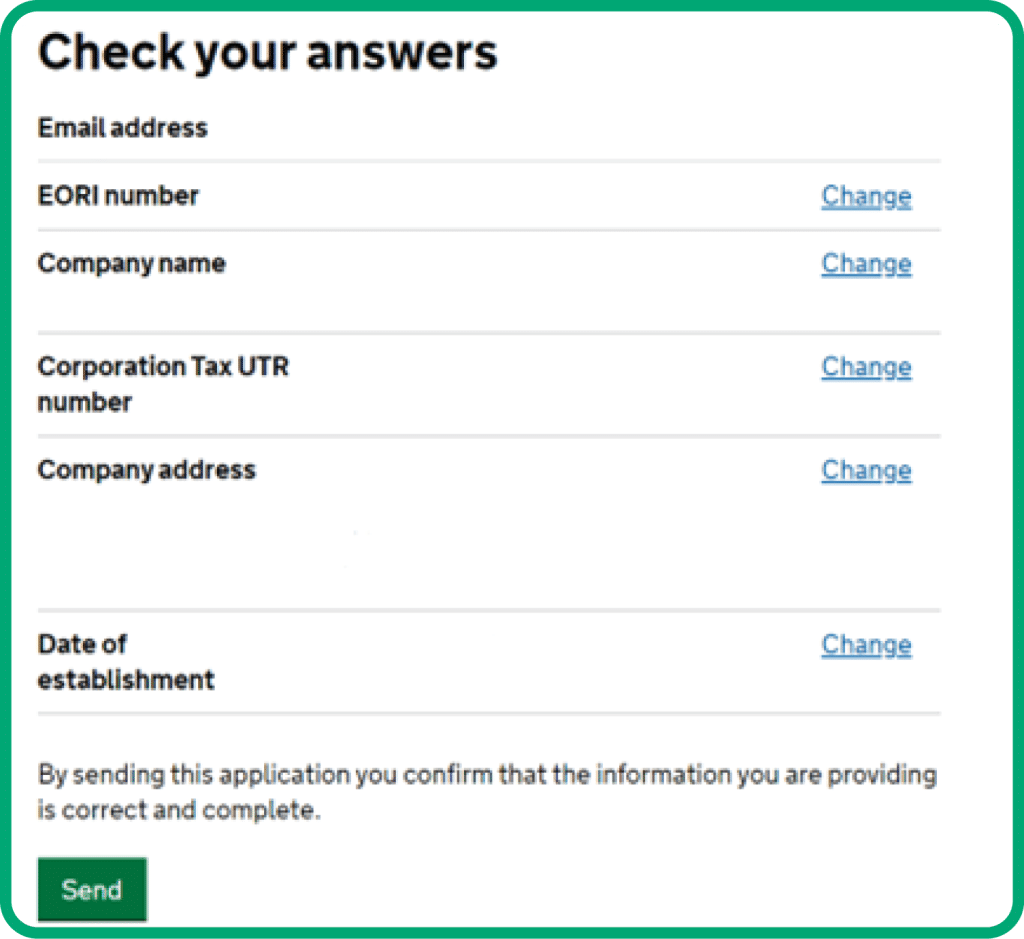

Finally, check your answers are correct and accurate before sending to HMRC for review.

After submitting it may take time before a response is received from HMRC. The email address you entered at the start of the application will receive the result of the application.

Once your application is successful you can then log in to HMRC’s online services and add other users to your account. https://www.gov.uk/log-in-register-hmrc-online-services

Sign in and select ‘Manage account’ and then select ‘Add or delete a team member’ and then add a team member by entering their name and email address.

The new team member will receive an email from Gov Gateway with a 12-digit ID and you will receive an email with a temporary password for them to use.

Once the new team member has registered, return to your log in and select ‘Manage account’ and select ‘Give a team member access to a tax, duty or scheme’ and assign the team members to the required services.

Your registration should then be complete, and you can move onto steps below.

You can find more information on the steps to take here:

STEP 2: Arranging your financial accounts for CDS

STEP 3: Providing a standing authority to use your financial accounts

If you have any questions, please contact us on CDS@goodlogisticsgroup.com